Update 08/16/2022

President signed a sweeping $750 billion health care, tax, and climate bill into law at the White House.

This historic climate investment calls for a 10-year extension at 30% of the installed equipment's clean energy cost, which will decrease to 26% in 2033 and 22% in 2034.

For 2022, All installations after January 2022 can claim a 30% tax credit for going solar.

Just as the time for the end of the solar tax credit was drawing near, Congress passed its relief package at the end of 2020, with some heralding it as the Energy Act of 2020. On Sunday, December 27, 2020, President Trump signed the omnibus spending and COVID relief bill into law. This bill provided necessary financial relief for businesses and individuals impacted by COVID and kept the government moving through the pandemic.

As part of the spending bill, known as HR 133, the government extended the federal solar investment tax credit (ITC) for a few years. Here’s what you should know about the solar tax credit extension and how it may affect your solar installation.

This substantial environmental win gave provisions for reducing hydrofluorocarbon (HFC) emissions, funding for renewable energy research and development, extensions for the existing solar energy credits, and tax credits for off-shore wind-based projects. With the solar tax credit, or investment tax credit (ITC), set to decrease in 2021, this legislation gave those installing new solar projects two additional years of federal tax credits.

Since 2006, the solar ITC has encouraged more than 50% average annual growth for the solar industry but has relied on new legislation to keep it running throughout the past 15 years. Without the federal tax credit, it would have been challenging for residential solar installation to develop adequately against the long-standing fossil fuels.

This federal solar tax credit gives homeowners a more even playing field to grow into renewable energy for now and the future. More development is still needed, though, with many scientists saying 2021 is the start of the last decade to get our act together with environmental issues.

Solar Tax Credit Extension Details

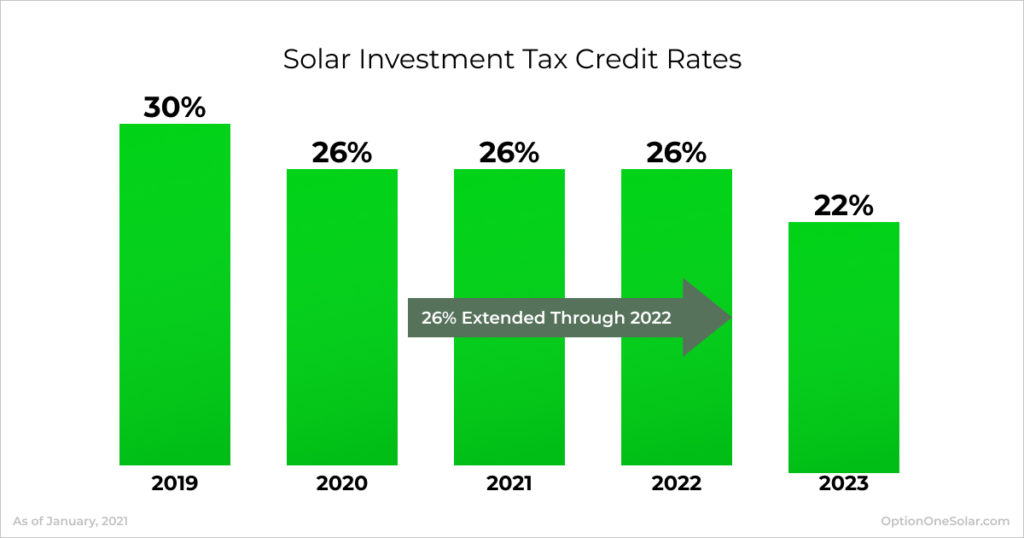

The laws give new solar power projects (including all qualified solar energy storage systems) a 26% credit for two more years. Instead of declining to 22% this year as initially planned by the original 2015 extension. The new package extends the 26% rate for projects starting through the tax year 2022 for all residential and commercial installations. The solar ITC will drop to 22% for all projects in 2023 and will be removed entirely the following year.

Update: 08/16/22 – United States President signed the Inflation Reduction Act into law at the White House today.

This historic climate investment calls for a 10-year extension at 30% of the installed equipment's cost, which will step down to 26% in 2033 and 22% in 2034. For 2022, All installations after January 2022 can claim a 30 percent tax credit for going solar.

History Of The Federal Solar Investment Tax Credit

This federal solar incentive program was established by the Energy Policy Act of 2005, which was initially set to expire in 2007. Due to its popularity, Congress extended the expiration date several times, including the extension we are discussing now. Here is a short timeline of the many extensions:

- 2006–2019: The solar ITC stayed at 30% of the entire cost of the system

- 2020–2022: Property owners that install solar panels during this time get 26% back on their taxes.

- 2023: Owners with new solar power systems installed can deduct 22% from their taxes.

- 2024: Only new commercial solar energy systems get 10% off at tax time. The federal credit for residential systems will be removed entirely in 2024.

- 2022-2032: a 10-year extension at 30% of the cost of the installed equipment, which will then step down to 26% in 2033 and 22% in 2034.

Read More:

How To Claim The Solar Tax Credit – IRS Form 5695

The Best Guide To California Solar Contract

Guide to Time-of-Use Rate Plans

Solar Battery Systems for Homes and Families

How The Solar ITC Works

If you own your solar panel system, you are eligible for the solar ITC. Even if you don’t have enough income tax liability to claim the entire amount in one year, it will roll over each year until you use it all up. Remember that you are not eligible for the solar tax credit if you sign a solar lease or PPA. If you are stuck in a solar lease, we can provide some advice for that situation.

To claim the 30% federal solar tax credit, you must own your panels, have them installed during 2022, and use IRS Form 5695 when filing your taxes. We advise that you consult a tax professional when filing with complex credits like the ITC. For more information, please visit our guide to the Solar Tax Credit.

The Time To Go Solar Is Now

The next two years are the window to take advantage of the solar tax credit on any of your solar projects. Don’t wait to save your hard-earned money and get started today with reliable and expert professionals like Option One Solar.