The Inflation Reduction Act was passed by The US House Of Representatives on August 13, 2022. After being approved by the Senate on August 8, 2022, this sweeping legislation will be signed into law today (August 16, 2022).

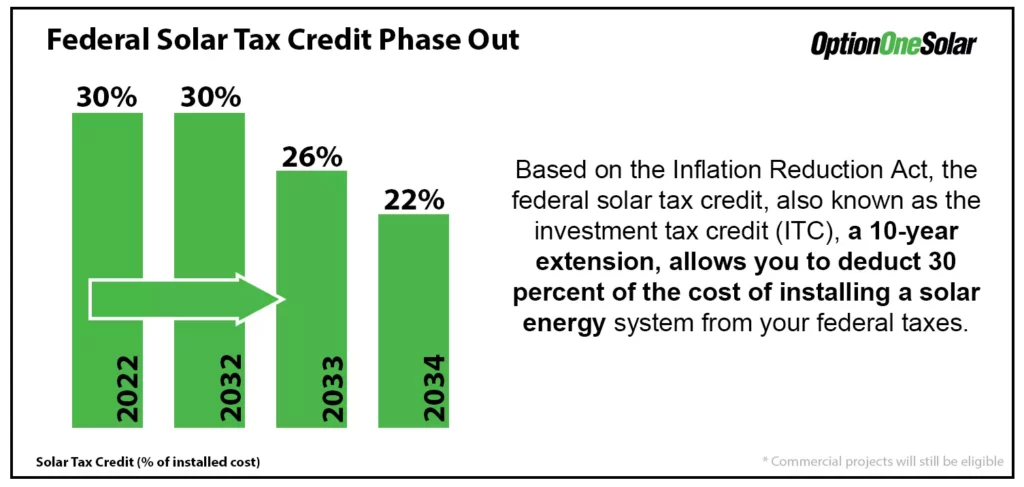

The bill calls for a 10-year extension at 30% solar ITC of the cost of the installed equipment, which will then step down to 26% in 2033 and 22% in 2034.

The $750 billion dollar Inflation Reduction Act will achieve several key legislative items, but the most important for us will be the largest climate investment in American history.

Key Items From The Inflation Reduction Act:

- Expand Medicare Benefits

- Lower Energy Bills

- Historic Climate Investment

- Lower Heath Care Costs

- Create Manufacturing Jobs

- Invest In Disadvantaged Communities

- Close Tax Loopholes

- Protect Families & Small Businesses

Inflation Reduction Act – How Does It Effect Solar?

After the new bill is signed into law today, what will it mean for the solar industry?

The Inflation Reduction Act – known technically as H.R. 5736 – is over 700 pages of dense legal terms that can be difficult to understand.

Let’s take a look at the details of the biggest climate investment in our country’s history.

Solar Investment Tax Credit

The Solar Investment Tax Credit has been increased back to 30% and can now be transferred to other taxpayers!

The 30% credit applies to both residential and commercial projects, including all projects installed in 2022.

Yes, that’s right! Every solar project from this year will be eligible for the 30% tax credit!

The 30% tax credit will also be applied to energy storage projects, even if they are not directly tied to a new solar installation.

Interconnection costs will also be included in the tax credit for all projects below 5 megawatts in size.

In 2025, the Solar Investment Tax Credit will change into a broader credit that can be applied to any emission-reducing project. The solar tax benefits will not change until 2032.

Read more:

Net Zero & The Importance of Solar Panel System Size

Top 10 Solar Panel Benefits – Reasons to Go Solar

Solar Investment Tax Credit (ITC) – What You Need to Know

New Tax Credit Adders

In addition to the big solar Investment Tax Credit, there will be a bunch of new ways to get even more of your investment back from the Government.

Will all of the additional credits combined, taxpayers could potentially get tax credits as high as 60%! However, these additional credits are not guaranteed, so you should contact our experts to see just how much you can get back on your taxes.

Contact us today to see how much you can save.