Update 08/16/2022

A new sweeping $750 billion health care, tax, and climate bill into law at the White House today.

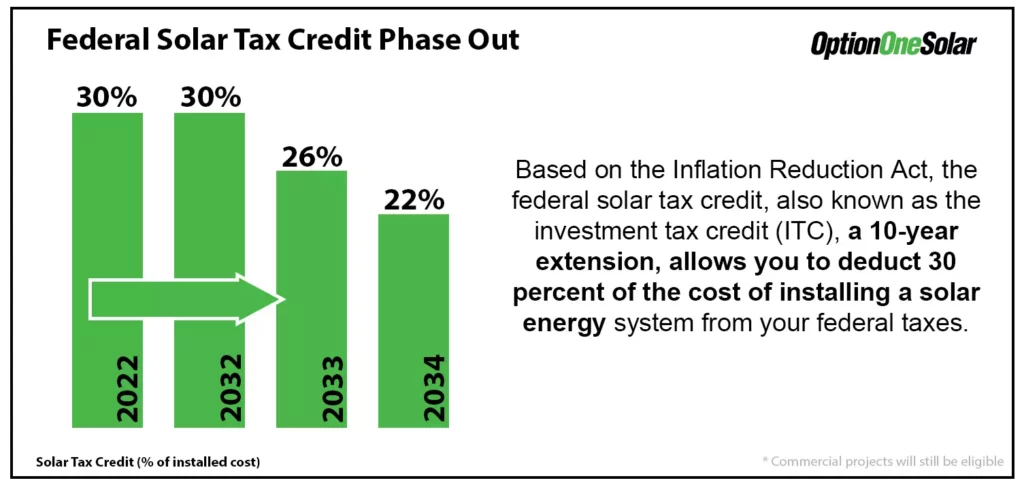

This new climate investment calls for a 10-year extension at 30% of the cost of the installed equipment, which will then step down to 26% in 2033 and 22% in 2034. For 2022, All installations after January 2022 can claim a 30% tax credit for going solar.

The Solar Tax Credit, also known as the Solar Investment Tax Credit (ITC), is a staple for solar development nationwide since the Energy Policy Act of 2005.

This federal tax credit offers buyers of solar power systems incentives to reduce the amount of taxes owed or pay the following year after their purchase.

Solar ITC helps homeowners, and commercial businesses, to afford solar technology, especially during the beginning when costs were higher than they are now. This article explains the ITC and why it's crucial to invest before it changes.

[caption id="attachment_10798" align="aligncenter" width="1024"]

Updated 08/16/2022 - New Solar Investment Credit[/caption]

How does the Solar Tax Credit work?

First, you have to buy a solar system. That fact is probably apparent, but the math fun begins after that. You will bring the "receipt" of your solar system purchase to your tax processor the following year. The amount you claim can be from any of the following areas:

Solar equipment (including battery storage)

Freight shipping costs

Solar consulting fees

Professional installer fees

Electrician fees

Engineer fees

Tools bought or rented

Wiring, screws, bolts, nails, etc.

Equipment purchased or rented (scaffolding or a man-lift, for example)

Permitting fees

Permitting service costs

Contractor Costs (if you hire out instead of installing yourself)

Roofing Repairs or Replacement

Even if you install the system yourself, which will have you dealing with the electrical code, approval, and permitting. In that case, you can still claim the equipment purchases and other items on the above list.

UPDATED - The Inflation Reduction Act signed into law now extended 10-year 30% solar tax credit.

Accounting for all your solar project costs, your tax processor can total those costs and use 30% of that sum to lower your taxes. For example, all said and done, you end up paying $21,000 for your solar energy system. That would give you a $6,300.00 solar tax credit, and you'll pay $6,300.00 less in federal taxes.

You will get a 30% credit based on your solar system’s total cost, including all the items listed above. You can use this 30% to offset taxes owed, and if you already paid this amount through tax withholdings on your paycheck, you can get it as a refund!

We recommend consulting with your tax professional to ensure you are filing everything correctly. We are not tax professionals, but we provide our customers with the documents and direction they need to get the most out of their solar investment, including this solar power tax credit.

Understanding Federal Solar Investment Tax Credits (updated):

To qualify for the 30% Federal Tax Credit:

Install your solar system during the year 2022 or after.

You must own your home.

You must pay or owe federal taxes in order to use the tax credit.

You must own your solar, and it must be new. (Leases Not Allowed)

Tax Credit vs. Tax Credit Refund

It is important to understand that this is a federal solar investment tax credit, which means you must pay or owe federal tax. Typically you pay this through your paycheck if you are a W-2 employee. You can only use this tax credit to offset taxes owed or create a refund of taxes already paid through payroll in the installation year. You can not get the money that you did not pay in or owe, meaning you have no tax liability. For example, if you are on permanent disability and it is non-taxed, you have no taxable income, and therefore the tax credit may not apply. However, you can go backward and pay off any owed taxes from previous years.

Qualifying for the Solar Tax Credit

W-2 Employee

Employees with paychecks usually pay taxes through payroll automatically, creating a refund or liability depending on elected withholdings, which are adjustable at any time. You can pay more to the IRS by increasing your withholdings resulting in a larger refund, or you can pay less and withhold the same amount you would get refunded. Instead of paying money to the IRS, divert that money toward the solar system.

Self Employed

If you are self-employed, you typically pay taxes owed on a quarterly or annual basis. You can use the tax credit to offset taxes you owe, and instead of paying money to the IRS, you divert that money toward the solar system.

It’s simple, give it to the IRS or Keep it yourself!

It’s important to note that the tax credit can carry forward, which means you can use any remainder from this year as a credit for future years.

Real-World Examples

Solar ITC Example 1:

Homeowner #1 buys a $30,000 solar system, meaning they are eligible for a $9,000 residential energy tax credit (30% of system costs). They owe the government $10,000 in taxes through their employment wages, but the withheld amount was through payroll, so they end up owing nothing when they file because they already paid the liability owed. In this example, when applying the solar tax credit to the $0 balance they owe the government, they receive a tax REFUND of $9,000. They can then take this and apply to their solar loan and pay it down. You are getting to keep $9,000 of your own money.

Solar ITC Example 2:

Homeowner #2 buys a $30,000 solar system, meaning they are eligible for a $9,000 residential energy tax credit (30% of system costs). They owe the government $9,000 in taxes through their employment wages, but this customer did not withhold any money from their paychecks and still owes $9,000 when they file. They will apply for their $9,000 tax credit and offset the $9,000 of taxes owed, which leaves zero taxes owed. In this example, the money they would have had to pay the taxes offsets due to the tax credit, but now that money is available to buy down the solar loan.

If the tax credit is greater than your overall tax liability (taxes owed), then you can carry this over to further years. You can also use tax credits to pay back taxes owed, meaning you can go backward.

How do I use the tax credit to pay down my Solar loan?

You have a 30% solar tax credit amount to utilize, and you can wait till you get a refund or accumulate the funds through higher payroll deductions. You can pay your solar loan down anytime within 18 months, and the finance company will lower your balance resulting in a lower payment. If you have enough cash on hand equal to the 30% tax credit and you’re in a position to apply it to the loan upfront, this will give you a smaller loan and payment and interest savings right now. You reimburse yourself when you receive the tax credit from the two options above.

Important Disclaimer: We understand how the tax credit works, but we are not tax advisors. This information is only for your reference. Everybody has a different financial and tax situation, and the above is intended as an example only. Always talk with your tax advisor.

Read more:

How To Claim The Solar Tax Credit - IRS Form 5695

A Guide To Understanding Solar Quotes

What is the best solar option: Cash - Finance - Lease - PPA

There are a few options when you invest in a solar energy system. You can buy outright, finance, or choose a lease or PPA. With buying and financing, you own it, get to claim the ITC federal tax credit, and have the highest return on investment (ROI) over leasing and PPA.

If you use cash, you can reimburse yourself with the tax credit.

If financing, most customers use the tax credit to pay down the loan. Typically customers choose our 2.99% fixed rates program for 12, 20, or 25 years.

However, if you lease your solar system, the leasing company gets to claim the solar tax credit and makes money off you. Since you never own it, it's basically like switching to another electric company at a slightly lower cost.

Solar Cash Purchase

A cash purchase typically offers the highest return on investment and the shortest payback. Our average customer return on investment is over 16% and less than 5 years of payback time; we have many customers who see over 20% returns and less than 4-year paybacks. The higher the electric consumption and bill, the higher the return. Under this program, you keep your tax credit.

Solar Financing

If you are not in a position to pay cash outright for your system, financing is the best alternative; Option One Solar has over 30 years of experience in financing; we offer zero down, zero out-of-pocket programs with as low as 2.99% fixed rates for 12, 20 or 25-year terms. Under this program, you keep your tax credit. But the tax credit can include all fees, including finance fees and points.

To maximize your total investment, we take the standard 8.99% solar loan rate and buy it down to 2.99%, basically converting long-term interest into upfront points and fees that can be included in your tax credit, thus increasing your total credit. This option allows 30% of all costs, fees, points, etc., and maximizes your entire investment and tax incentive.

PPA or Lease (DON'T DO THIS!)

Some homeowners may consider leasing their solar systems or enter into a home solar PPA, power purchase agreement. We would only recommend these two methods as a last resort and only if financing is not an alternative or the best return on investment for your financial plans or needs. On a lease or PPA agreement, the company keeps YOUR tax credit. Under this program, you do not keep your tax credit. In most cases, we can prove that our financing program will have a better return on your investment, even if you can not get the tax credit.

How do I claim the Federal Tax Credit?

That's a simple question to answer. You file an IRS Form 5695 with your 1040 Individual Tax Return (full IRS Form 5695 found here).

To learn how to fill out the applicable IRS forms to claim your Solar Investment Tax Credit, visit our Solar Learning Center Article, Claiming the Solar Investment Tax Credit.

Key Solar Tax Credit Takeaways

As you read below, here are the key takeaways to remember for the Solar Investment Tax Credit:

The Solar Investment Tax Credit has been increased back to 30% and can now be transferred to other taxpayers!

The 30% credit applies to both residential and commercial projects, including all projects installed in 2022.

Yes, that’s right! Every solar project from this year will be eligible for the 30% tax credit!

The 30% tax credit will also be applied to energy storage projects, even if they are not directly tied to a new solar installation.

Interconnection costs will also be included in the tax credit for all projects below 5 megawatts in size.

In 2025, the Investment Tax Credit will change into a broader credit that can be applied to any emission-reducing project. The solar tax benefits will not change until 2032.

For more answers to going solar - Solar FAQ

Why act now?

These solar incentives won't last forever, and expectations are they will go lower and offer fewer benefits. Buying your system before 2023 will be able to grandfather NEM 2.0 for next 15 years to get more electricity buy-back credit from utility providers.

Take advantage of this solar tax credit by getting award-winning professional help today!

[rank_math_breadcrumb]