Solar PPAs (or Solar Power Purchase Agreements) are a predominant financing choice being considered by many homeowners. A Solar PPA is very similar to Solar Lease, just like leasing anything - You don’t own it. You get a lower-levelized payment, but this arrangement may result in missing out on significant potential savings or advantages.

It’s like renting part of your property to a power company, and only you’re paying the rent!

Let’s take an in-depth look at the Solar PPA:

What are Solar PPA agreements?

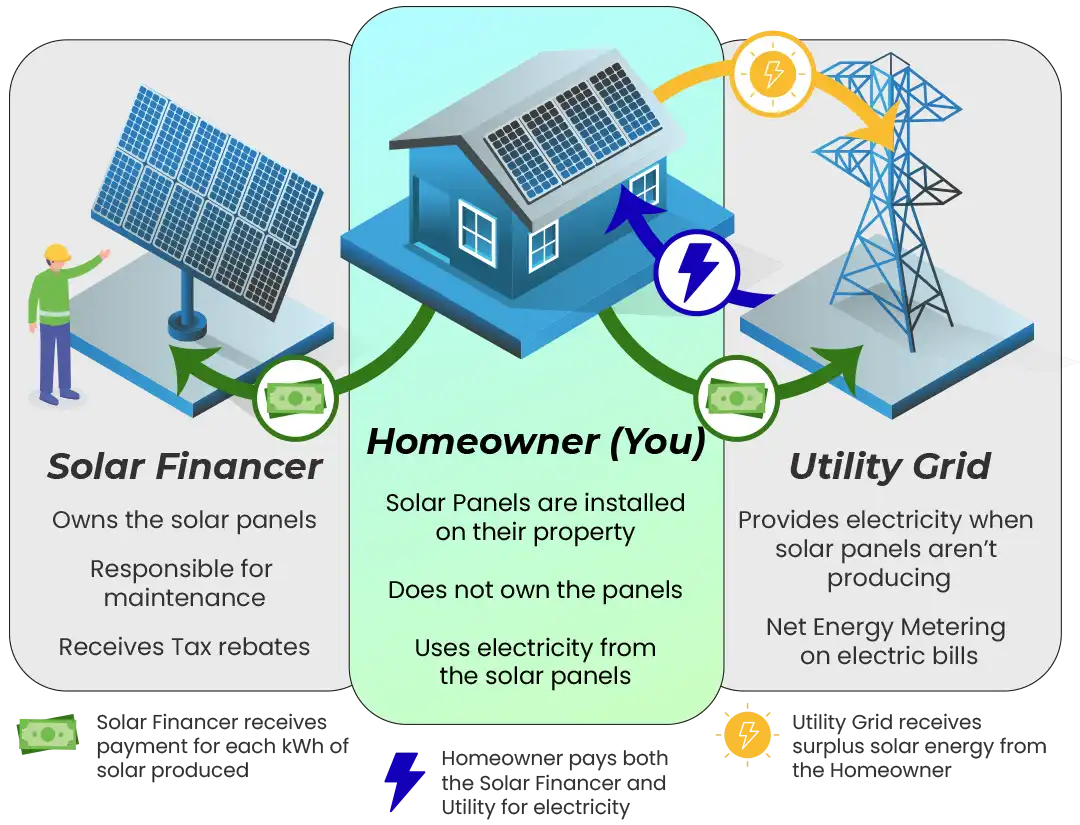

A Solar Power Purchase Agreement (PPA) is a financial arrangement in which a third-party developer owns, operates, and maintains a solar installation on a customer's property.

You will be entering into a contract with a third-party solar developer. The customer agrees to purchase the solar-generated electricity from the third-party owner at a predetermined rate for a specified period, usually ranging from 10 to 25 years.

How Does a Solar PPA Work?

You will be entering into a contract with a third-party solar developer. The customer agrees to purchase the solar-generated electricity from the third-party owner at a predetermined rate for a period of 10 to 25 years.

This allows the customer to benefit from solar energy without the upfront costs and maintenance responsibilities associated with owning a solar system.

More about solar: Tips to Identify The Best Solar Company 30% Solar Tax Credit Is Back! - Inflation Reduction Act Solar FAQ

PPA Advantages and Disadvantages

Solar Power Purchase Agreements don’t provide any advantages to residential homeowners when compared to purchasing solar panels.

What are the Pros and Cons of a Solar PPA?

Advantages:

No Upfront Costs: Customers can install solar panels without the initial capital investment.

Lower Electricity Rates: The PPA rate is often lower than the retail electricity rate, offering immediate savings.

Hassle-Free Maintenance: The third-party owner takes care of system maintenance and repairs.

Disadvantages:

Additional Electricity bills may occur

Long-Term Commitment: PPAs require a long-term contract, which may not be suitable for all customers.

Limited Control: The customer does not own the solar system and has limited control over it.

Potential Escalation Costs: If the PPA includes an escalation clause, the cost savings may diminish over time.

However, Solar PPA has better advantages for commercial solar systems:

Commercial solar PPA can provide cost savings for business owners, as they can avoid upfront costs for purchasing and installing solar equipment. Instead, the customer pays for the energy produced by the solar system at a predetermined rate, which is often lower than the retail electricity rate.

The PPA for commercial solar projects also offers predictable energy costs for businesses, as the rate for electricity is fixed for the duration of the agreement, typically 10 to 25 years. This can help the customer with long-term budgeting and planning.

The Commercial Solar Power Purchase Agreement can reduce the financial risk for the business owners, as the developer is responsible for financing, installing, and maintaining the solar system. The customer can focus on their core business activities while still benefiting from solar energy.

Is A Solar PPA Worth It?

A Solar Power Purchase Agreement (PPA) can make sense in various circumstances, depending on your financial situation, energy needs, and long-term objectives.

Financial Constraints:

Limited Upfront Capital: If you don't have the financial resources for the initial investment required for a solar installation, a PPA can provide a way to go solar without any upfront costs.

Desire for Immediate Savings: A PPA often offers a lower rate for electricity than your current utility rate, allowing for immediate savings on your electricity bills.

Operational Considerations:

No Interest in Maintenance: If you prefer not to deal with the operational aspects of maintaining a solar system, a PPA is advantageous because the third-party owner takes care of all maintenance and repairs.

Market Conditions:

Increasing Electricity Rates: In regions where electricity rates are high and expected to rise, a PPA can offer significant cost savings over time.

Energy Needs:

Stable or Increasing Energy Consumption: If you anticipate that your energy needs will remain stable or increase in the future, locking in a lower electricity rate through a PPA can provide long-term financial benefits.

Sustainability Goals: If you or your organization have specific renewable energy or sustainability targets, a PPA can be an effective way to achieve those goals without a significant capital outlay.

Solar PPA Vs. Lease

Ownership and Maintenance:

PPA: A third party owns the solar system, and you purchase the electricity it generates.

Lease: You lease the solar system from a third-party owner but do not purchase the electricity separately.

In both cases, the third-party owner is generally responsible for maintenance and repairs.

Payment Structure:

PPA: You pay for the electricity generated by the solar system at a predetermined rate per kilowatt-hour (kWh).

Lease: You pay a fixed monthly lease payment, regardless of how much electricity the system generates.

Financial Benefits:

PPA: Your savings are directly tied to the amount of electricity generated. If the system performs well, your savings could be higher.

Lease: Your savings are more predictable but may be lower since they are not tied to performance.

Contract Length:

PPA: Typically ranges from 10 to 25 years.

Lease: Also ranges from 10 to 25 years but may offer more flexibility in terms of contract length.

End-of-Term Options:

PPA: At the end of the contract, you may have the option to extend the PPA, purchase the system, or remove it.

Lease: You can generally buy the system, extend the lease, or remove the system.

Rate Escalation:

PPA: This may include an escalation clause that allows the rate you pay for electricity to increase over time.

Lease: Lease payments may also include an escalation clause, but this is not tied to electricity rates.

Transferability

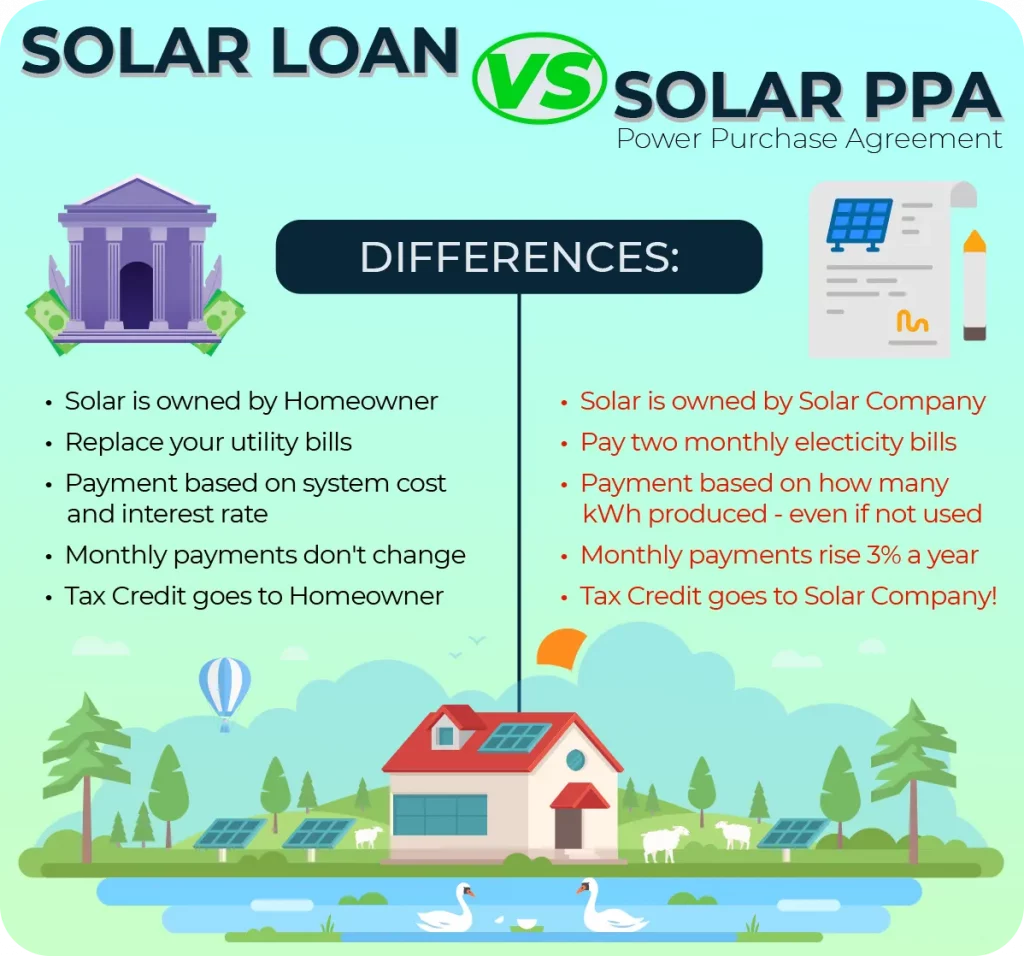

Solar PPA Vs. Full Ownership

When you compare a Solar PPA Vs. buying solar panels, you realize just how a solar PPA is for homeowners.

When you get a Solar Loan, you will own your solar panels. You get all of the benefits: The tax credit, NEM, an increase in your home’s value, savings over utility bills, and complete ownership of your own property. For more answers to going solar - Solar FAQ

In Summary: Solar PPA and Lease are a choice of options!

When you purchase your solar energy system outright or through a solar loan, you get to own the solar panels and all the power they produce.

After the initial payback period of 5-10 years, your solar panels will produce free energy for as long as they last. They generally require very little maintenance and usually last longer than 25 years.

Invest smart - Buy solar panels and batteries from a trusted, award-winning solar installer. Owning solar can be 5 times lower cost than the utility company and can have returns on investments exceeding 20%. Call us for a free financial benefit analysis and find out for yourself.

[rank_math_breadcrumb]